Is Now the time for Amazon? Only time will tell.

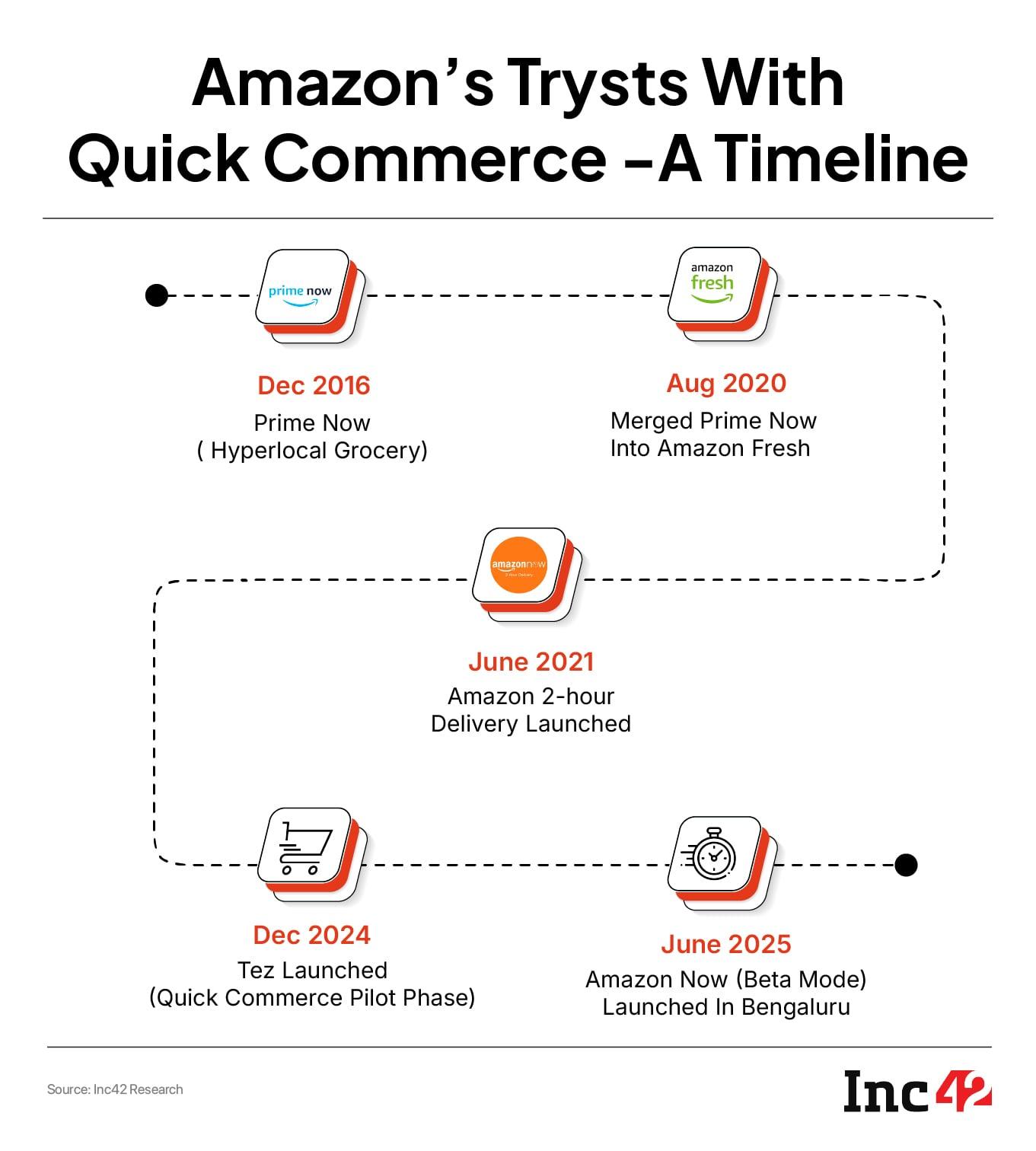

After three earlier attempts, Amazon took off yet again to hit India’s rapidly growing quick commerce turf with Amazon Now, after a months-long pilot phase. The Seattle-headquartered ecommerce giant has just announced its entry into the 10-minute delivery format in parts of Bengaluru.

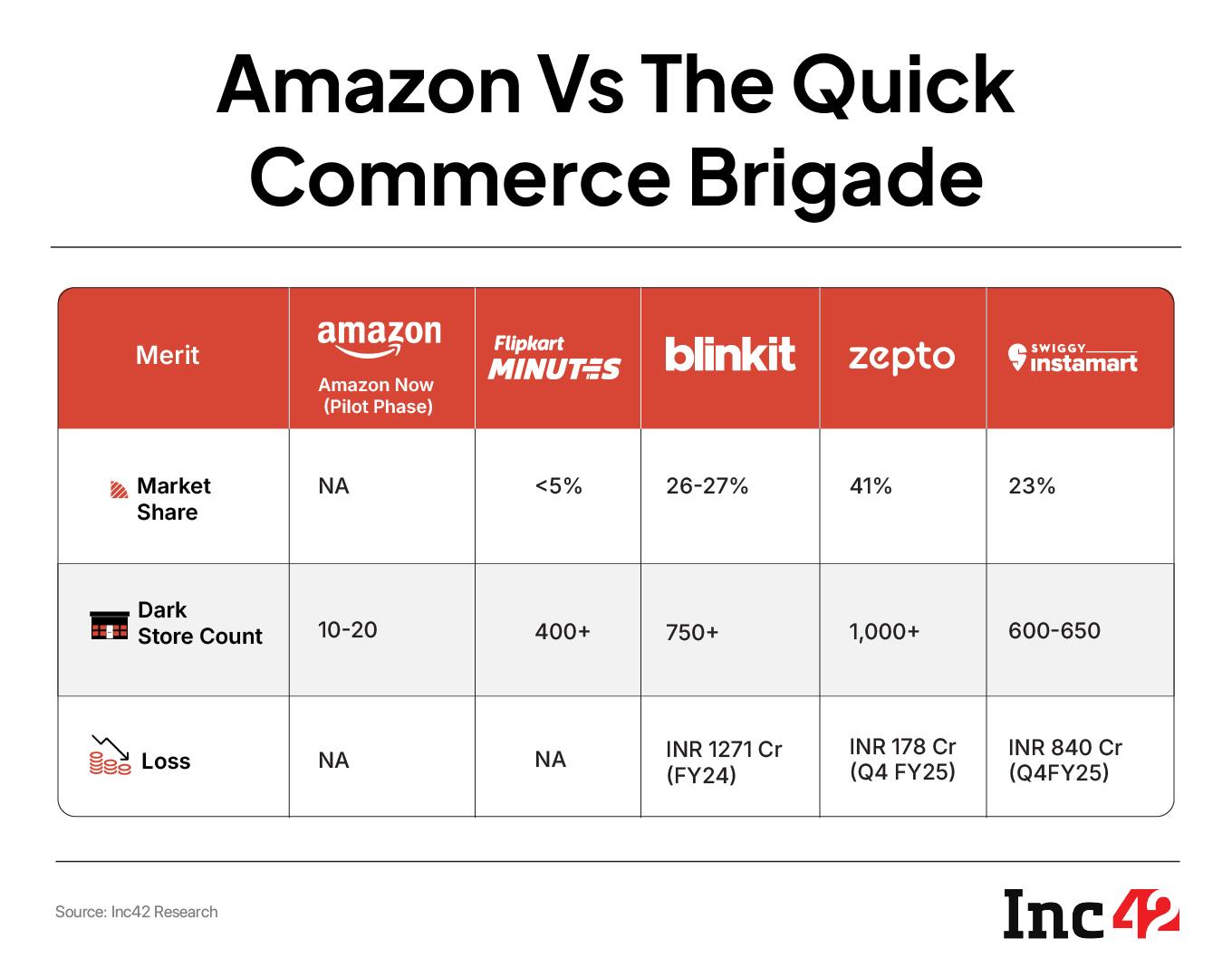

“The initial idea is to set up 10-20 dark stores in three or more pin codes and eventually scale it to a few more cities as the festive season sales come closer,” an Amazon insider said, refusing to be identified.

In a report titled, Quick Commerce: Another Month, Another Player & This Time It’s Amazon Now, US investment bank Jefferies noted that as a late entrant into India’s $5 Bn quick commerce market, which is likely to exceed $11 Bn by 2030, Amazon will have to consider serious scaling in terms of coverage to compete with seasoned players.

For Amazon, which accelerated the ecommerce revolution in India, it is not a question of simply jumping on the bandwagon. The stakes are really higher than what even its leadership perceived a few years ago. The entry into the fast-delivery segment by Amazon or its rival Flipkart has been a compulsion, noted the brokerage, citing an ever-expanding ambit of quick commerce players like Blinkit and Zepto.

Several sources in Amazon India admitted that the company’s topline was being hit harder by the quick commerce incumbents than its fierce competitors like Flipkart, or even Meesho.

“I think they are two years late from when they should have been in quick commerce,” a top industry observer, familiar with Amazon India’s business operations, told Inc42.

“The internal leadership dynamics within the company which also underwent change last year was not fully aligned with the quick commerce execution.”

The Indian arm of the US retailer has replaced Manish Tiwary with Samir Kumar as the country manager. The restructuring came at a time when Amazon marketplace showed muted revenue growth of 3.4% and 14% in FY23 and FY24, compared to a 49% and 33% surge in the previous two years.

Out of a total marketplace revenue of INR 25,593 Cr in FY24, Amazon’s ad revenues grew substantially by 24% to INR 6,649 Cr, while revenue from third-party sellers increased only 14% to INR 14,285 Cr.

This depicts a gloomy picture of Amazon’s core businesses stagnating under regulatory pressure and in the face of quick commerce onslaught.

“This is where the problem is. The core marketplace business, seller revenues are declining and quick commerce is a major reason for that. It has proven to be a game-changer in the urban centres, more precisely, the top eight cities of India which were Amazon’s key markets,” Sateesh Meena, who heads research advisory firm Datum Intelligence, told us.

“It’s worse because Amazon’s revenue engine – the Prime customers – is confined largely to these places. The consumers have been dividing their wallet share with quick commerce platforms.”

Prime Time Gone, Now It’s About GirdingFor almost a decade, Prime has been driving the Amazon juggernaut with repeat purchases and long-term stickiness among users. But, there’s a visible rot in the system. The 10-minute delivery apps are snatching away a chunk of Amazon Prime customers in the top eight cities.

Amazon has designed its quick commerce vehicle to reclaim Prime’s utility as a value proposition, not just for two-day deliveries and entertainment bundles, but for everyday consumption. If that linkage isn’t rebuilt, Amazon may be in for a worse churn in its loyal customer base.

The June 16 Jefferies report said that Amazon is playing the discount card to lure back its customers and attract new buyers. For Prime members, it has lowered the threshold for free deliveries to INR 99, while for others, it is INR 199. The Prime members are also not charged additional fees like surge, handling, rain or late-night charges.

But, as the Prime wallet splits between Amazon and quick commerce platforms, the company has mandated Amazon Now to outdo its rivals with higher discounts and cashbacks. “It is offering a cashback of INR 70 on all orders above INR 299 and INR 150 for orders above INR 649, to Prime users. Non-Prime users do not enjoy benefits such as a waiver of the INR 10 handling fee and also receive lower cashbacks,” the brokerage noted.

The discounts offered, particularly in groceries or dairy products, are higher than the existing players. Amazon was never into groceries and dairy in a big way. In small appliances, home dècor items and event-based products, Amazon could edge out its ecommerce rivals with its Prime userbase.

“That’s where the quick commerce platforms are eating away the market share. It is this cohort of users that Amazon wants to protect at all costs,” Meena said.

Prime users who have bought a subscription of INR 1,499 for higher frequency, lesser ticket-size, unplanned purchases, are now turning towards alternatives like Zepto, Instamart and Blinkit that are biting into the Amazon sales pie.

“Non-Prime shoppers on Amazon have an average order value (AOV) of around INR 1,000-1,200, but it nearly doubles to INR 1,800-2,000 for Prime customers. They buy more frequently and across more categories,” a Datum Intelligence report said.

The founder of a Bengaluru-based ecommerce enabler firm said a substantial hike in annual subscription fees for Prime members too has hurt its revenue. The leverage of providing free content on Prime video under the subscription is also going away since Amazon has introduced rental features and ads while streaming and other monetisation avenues.

“The real hook here was free deliveries, access to sales events and other cashback-related features. But the rival platforms are also offering some of these without an overpriced membership,” the founder pointed out.

Now is the time, felt the ecommerce behemoth, for a fresh shot at quick commerce as it looks to launch Prime Day sales during July 12-15. Industry watchers said the moat here will be to not let the existent Prime members switch to rivals with mega discounts on high-frequency purchase items.

Are Metros Now The Prime Focus?Amazon Prime has more than 200 Mn members globally with around 10 Mn in India alone. The company is likely to step up focus on the top eight to 10 cities, where the concentration of Prime members is highest and the dent made by quick commerce is deepest.

A dark store usually covers an area of 5-6 km radius. In high-demand zones, it is 2-3 km. Amazon needs to target these areas across top cities to make an initial impact, though this is strategically different from the logistics operations of its ecommerce venture.

Amazon had in June announced an INR 2,000 Cr investment to beef up its logistics infrastructure. “Part of it will fund the launch of new sites and upgrade of its existing facilities across fulfillment, sortation and delivery networks,” it said.

Money has never been a problem for the US giant, said Meena of Datum Intelligence, the hurdles were the execution, building the pipeline of short-shelf-life SKUs and delivery hassles. The capital push is expected to boost expansion in dark stores or fulfilment centres with a non-inventory model in place.

“Non-inventory-led, limited shelf-life, repeat purchase SKUs have worked very well for quick commerce players. Amazon needs to replicate its younger rivals,” suggested Amit Kumar, CEO of drone delivery startup Sky Air Mobility.

Time To Unlock Wealth In Smaller TownsKumar differs from what Amazon zooms in on. “It’s the convenience-led shift in consumer behaviour that worked in favour of quick commerce in post-COVID period,” he said.

The quick commerce buzz has echoed loud in metros. But it will take years to resonate in tier II cities, he said.

“I think Amazon and even Flipkart should replicate this in tier II and III towns and beyond, considering the investments and capabilities they have in these regions. It will unlock value.” He argued that almost 70% of the Indian retail demand comes from the non-metros and ecommerce is still not big enough to capture a dominant market share there.

Unlike quick commerce startups that built their networks from scratch, Amazon can leverage its established base to set up dark stores in non-metro cities, without any major rise in capital expenditure.

The challenge, however, lies in adapting Amazon’s quick commerce model to the price-sensitive nature of non-metro markets. While urban consumers prioritise speed, non-metro customers are more cost-conscious, necessitating competitive pricing and localised product offerings.

Lessons Learnt From The PastAmazon’s earlier attempts at quick deliveries failed because of operational inefficiencies, leadership crisis, inaccurate decision to build dark stores out of fulfillment stores and many such missteps.

In 2016, Amazon piloted Prime Now as a same-day delivery venture that lagged behind in adoption. Then came the 2-hour or slotted delivery model of Amazon Fresh in 2019 that expanded to many cities but received muted response. Last year, the company piloted Amazon Tez for its employees but was later repurposed.

Does the entry of a giant sound out an alarm?

“We are not scared of Amazon or Flipkart entering into the business. If it would have been just a capital game, they would have won it many years ago. But that’s not the case,” said the chief operating officer of a quick commerce player, requesting anonymity. “Quick delivery is a capital-intensive, operationally heavy exercise with inventory management, last-mile agility and SKU assortment as huge metrics.”

Meena said that for Amazon, instant deliveries have been a challenge globally and, in their home-market US, quick commerce never worked, which made the management drag its feet on the India gameplan too. After nearly three decades of presence in the US, Amazon is trying out a same-day delivery format with a $4 Bn budget for remote areas.

“I believe quick delivery was not in their DNA. But then even Blinkit’s earlier avatar Grofers failed before they were acquired by Zomato in 2022, which turned things around,” the ecommerce enablement startup founder said. “It is not a matter of choice for Amazon anymore. They are losing revenue share and next could be a loss of userbase.”

Amazon recently faced regulatory heat for violating FDI rules and had to disband entities like Cloudtail and Appario Retail, floated as JVs with Catamaran Ventures and Patni Group. This was in addition to the multiple lawsuits the e-tailer faced in recent times with local retailer bodies accusing it of unfair trade practices by owning inventories it sold.

The Amazon management is now treading cautiously, shying away from making big bets in a changing regulatory environment.

“They are not competing with just VC-funded startups anymore that they wanted to acquire at one point. Swiggy and Zomato are large public companies. Zepto is on its way to list and has completed its reverse flip to India. Flipkart will also go listed. There is a strong public and regulatory sentiment in favour of homegrown companies which could be a challenge for Amazon,” said a source.

Bazooka Or Slingshot? Acid Test AheadIndia’s $2.4 Tn consumer market is well on course to be the world’s second largest at $4.3 Tn by 2030.

For Amazon, which has always targeted the $1 Tn Indian retail industry, it’s a now-or-never opportunity to unleash its capital prowess and executional capabilities in a market dominated by younger quick commerce companies.

Industry analysts say that not losing their valued Prime customer base, building a dark store network to tap the top eight cities and eventually replicating this model in deeper territories still hold promise.

Amazon Now in its renewed push will face the acid test in the upcoming sales bonanza and festive seasons where Blinkit, Zepto, Instamart, BigBasket and even Flipkart Minutes are readying each one’s own game.

“One thing we have seen in quick commerce is that customer loyalty keeps shifting with change in discounts or some below-par consumer experience. If Amazon is able to get its act together this time, it could crack the quick commerce code finally,” Meena of Datum Intelligence said.

Now is the time or not won’t be a long wait to know, it seems.

[Edited By Kumar Chatterjee]

The post Losing Ground To Blinkit And Zepto, Can Amazon Reclaim Its Prime Edge? appeared first on Inc42 Media.

You may also like

'So, so...': Elon Musk's 14-word viral reaction to Trump's statement on deporting him to South Africa

Chilling moment man approaches home with shotgun before couple find car shot out

EastEnders' Ben Mitchell's 'return imminent' as Callum cheats with Johnny in shock twist

Arsenal transfers: Full confirmed list of summer ins and outs with first signing completed

Boost For Deeptech Sector: Cabinet Approves INR 1 Lakh Cr R&D Fund