Arattai is riding the latest wave of digital “swadeshi” sentiment. Zoho’s messaging app has gone viral, clocking 3.5 Lakh downloads in just three days and topping app store charts. So, why is Arattai taking India by storm?

The Downloads Paradox: Arattai has caught the fancy of India’s tech-conscious users with its end-to-end encryption, support for multiple local languages, and focus on data privacy. Yet, India’s messaging app history reads like a cautionary tale.

Hike Messenger attracted 100 Mn users before shutting down in 2021, and JioChat, Koo, and state-backed Sandes also failed to gain mainstream traction. Each promised a homegrown alternative to WhatsApp but ultimately fell short, unable to solve the critical bottleneck of user retention.

Solving The Retention Puzzle: Recognising the engagement gap, Arattai’s immediate roadmap includes building a richer file-sharing experience, integrating UPI, and steering completely away from ads or data monetisation. Focussed on earning trust through reliability, performance, and features, Zoho is also ambitiously exploring UPI-inspired interoperability, which could enable cross-platform messaging.

Caught In A Loop? Arattai’s claims of privacy face immediate scrutiny. While promising end-to-end encryption for voice and video calls, the app currently lacks this protection for basic text messages – the feature customers use most frequently. Unlike WhatsApp’s detailed security whitepaper or Signal’s open-source audited protocol, Arattai has no public cryptographic documentation despite existing since January 2021.

Then, there is also the challenge of convincing customers to migrate their entire social graph to Arattai when the Meta-owned platform already delivers everything.

This raises the question: Can Arattai break the cycle that claimed previous giants, or will it leverage Zoho’s deep resources and India’s tech-nationalism wave to achieve the unthinkable? Let’s find out…

From The Editor’s DeskZepto Eyes $400 Mn: The quick commerce giant is looking to raise the funding at a valuation of $7 Bn, up 40% from $5 Bn at which it was pegged earlier this year. To be led by US pension fund CalPERS, the round will comprise primary and secondary deals.

Simpl Axes 80 Jobs: Following the RBI clampdown, the buy-now-pay-later startup has laid off around 80 employees. The layoffs primarily impacted sales and marketing teams. Last month, the RBI told Simpl to stop all payment operations as it was operating without a licence.

Infra.Market Files DRHP: The building materials platform has pre-filed its IPO papers with SEBI via the confidential route. Infra.Market plans to raise around INR 5,000 Cr via its IPO, which will have equal components of fresh issue and OFS.

GoBoult’s Latest Courtroom Clash: A Bengaluru commercial court has issued an ad-interim injunction, restraining the brand from selling products under the name GoBoult. The court ruled that the name was deceptively similar to GoBold, a rival electronics brand.

Goldman Sachs Dumps Eternal Shares: The financial services giant sold 8.2 Cr shares of the foodtech giant in a block deal worth INR 266.9 Cr. The shares were lapped up by BofA Securities. Eternal also allotted ESOPs worth INR 211 Cr to employees.

Bachchans Sue YouTube: Actors Abhishek and Aishwarya Rai Bachchan have separately moved the Delhi HC against the streaming giant to protect their voice and image. The duo are seeking INR 4 Cr in damages and a permanent injunction against unauthorised deepfakes.

UPI To Remain Free: RBI governor Sanjay Malhotra has said that there is no proposal before the central bank to charge for UPI payments. Meanwhile, UPI transactions declined 2.5% MoM to 1,960 Cr in September while value remained almost flat at INR 24.9 Lakh Cr

Perplexity’s India Push: After OpenAI and Anthropic, AI giant Perplexity is now planning to set up a team in India. CEO Aravind Srinivas said that India has emerged as the biggest market for the company by user base, following its partnership with telecom major Bharti Airtel.

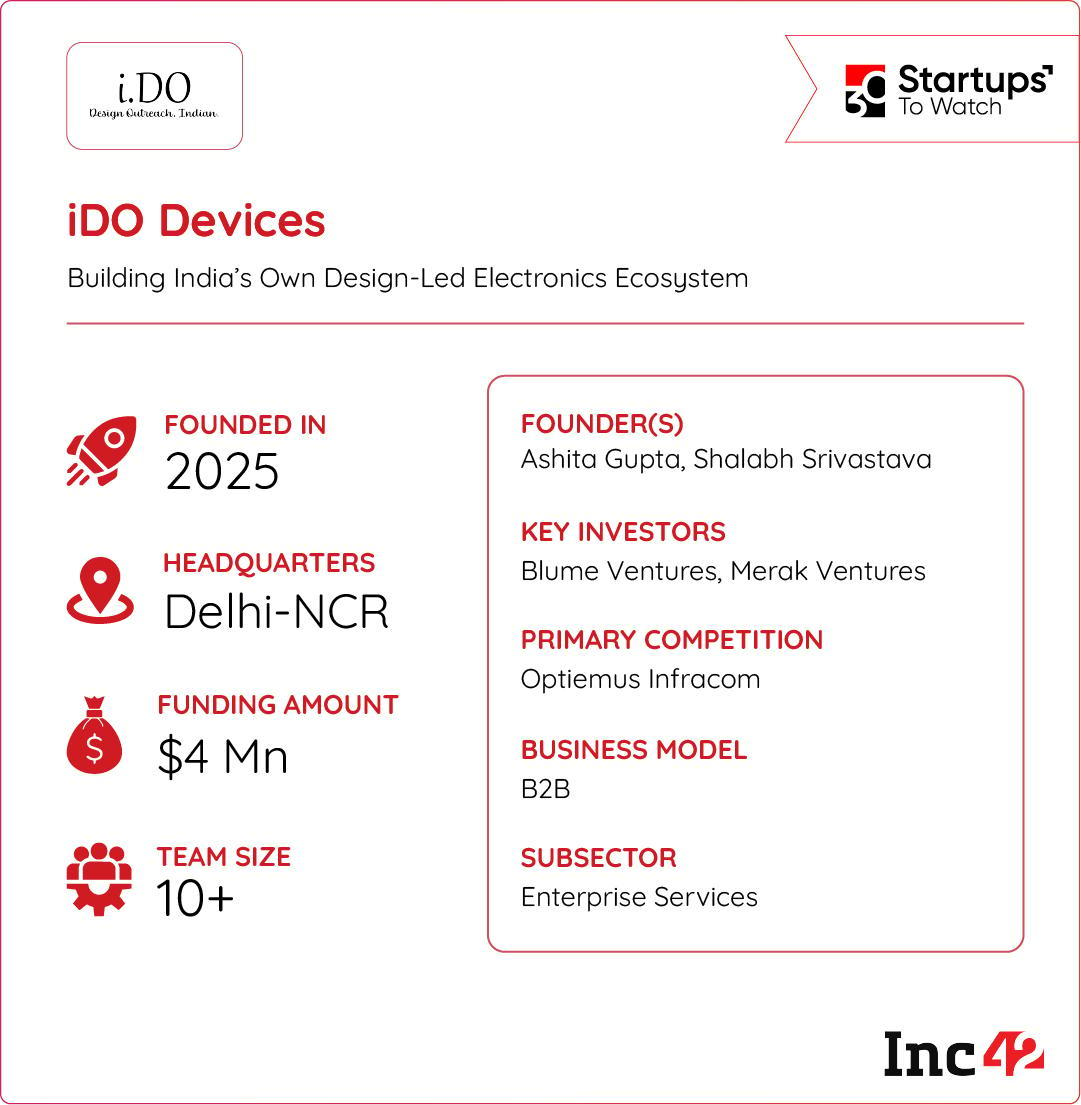

Inc42 Startup Spotlight Can iDO Fuel India’s Tech Manufacturing Dream?Despite India’s aggressive push for tech manufacturing, the domestic electronics ecosystem is marred by the dearth of end-to-end design and production companies. iDO Devices is trying to plug this gap, while reducing dependence on Chinese imports and fuelling local innovation.

A Made-In-India Solution: Founded in 2023, the Delhi NCR-based startup designs, develops, and delivers connected hardware products for its customers by leveraging its in-house design, firmware, mechanical, PCB, tooling, prototyping, and manufacturing capabilities.

The Hardware Playground: iDO Devices’ offerings span a diverse range of high-growth hardware categories, demonstrating its versatility and technical depth. Their product portfolio includes Bluetooth wearables, next-generation GSM-based phones, precise GPS-enabled trackers, and complex WiFi-powered smart devices.

Backed by names such as Blume Ventures and Merak Ventures, the startup has raised a nifty $4 Mn since inception. With the domestic electronics market projected to surge past the $400 Bn mark by 2030, can iDO become the backbone of India’s next-gen consumer tech?

The post Arattai’s Big Test, Simpl Axes 80 Jobs & More appeared first on Inc42 Media.

You may also like

Prince William zooms through Windsor castle on scooter and confesses worst trait

Panic in Balearic Islands as migrant arrivals soar 84%

Man Utd 'considered hiring ex-player' before Ruben Amorim – and he's still available

You have the eyes of a sniper if you can spot the cat hiding in optical illusion

What happened when I travelled to De Kuip with two of Aston Villa's 1982 European Cup legends